A First Timer’s Guide to Car Leasing

Behind a house, a vehicle is the largest purchase many people make in their lifetime. Rushing into a dealership without doing your homework can leave you at the short end of the stick. Many of the salespeople at car dealerships have their own best interests in mind, and they will say and do whatever they can to separate you from your hard-earned money. At Centennial Leasing & Sales, we don’t agree with these pushy tactics. Call us old-fashioned, but we believe that the customer comes first.

The world of car leasing can be confusing for first timers. Heck, it can even be confusing for second and third timers. To help make things a little less confusing, we’ve put together the ultimate guide to leasing a car. In this guide, we’ll cover everything from deciding to lease or buy to how to return the vehicle at the end of the lease term.

Guide to Car Leasing: Table of Contents

Learn the fundamentals of car leasing, including the application process, lease terms, and responsibilities.

2. Deciding if a Lease is Right for You

Examine the advantages and disadvantages between leasing and purchasing and determine which is right for you.

Understand the right questions to ask yourself so you can head into your lease with confidence and peace of mind.

4. Negotiation

Uncover the basics of car negotiation. Learn how to leverage speaking with multiple dealerships for the best lease price.

Follow these best practices during your lease to avoid extra fees and penalties at the end of your lease.

Identify the consequences of terminating a lease. Discover alternatives to help break the lease with minimal damage.

Find out how to prepare for the end of your lease with tips that ensure you return the vehicle in good graces and avoid fees.

Learn what happens when you return your leased vehicle and take advantage of insider tips to get a better deal.

Navigating leasing for the first time? Partnering with an auto broker saves time, reduces stress, & ensures the best deals.

How Does a Lease Work?

The official first step of leasing a vehicle is submitting an application. The leasing company asks for employment details and financial information to determine if the person leasing the car (the “lessee”) is eligible and financially capable of entering into the lease.

If the lease application is approved the lessee enters into a contractual agreement with a dealership or leasing company for a specified period. The most common term is three years, but two- and five-year leases are also available.

During the length of the term, the lessee agrees to follow stipulations outlined the in the lease agreement, such as:

- A yearly mileage allowance

- Required monthly payments

- Maintenance responsibilities

- Potential penalties or fees

After reviewing and signing the agreement, the lessee makes any required upfront payments before taking possession of the vehicle. At the end of the lease term, the vehicle is returned to the dealership for a lease-end inspection.

The inspection examines excess wear and tear, mileage overages, and the vehicle’s overall condition. Depending on the outcome of the inspection, the dealership may charge additional fees and penalties. Once the inspection is finished, the lessee may either return the vehicle and lease a new one, purchase the leased vehicle outright at its residual value, or return the vehicle and walk away.

What’s in the Lease Application?

A lease isn’t guaranteed to everyone. Before the dealership sends you off the lot in a new car, they must approve your lease application. The lease application typically exists to prove your creditworthiness and help determine the lease. Every application is different, but you should be prepared to provide the following information:

- Personal Information: Name, address, phone number, date of birth, email

- Employment Information: Employment status, current employer, job title, length of employment, monthly income

- Financial Information: Credit score, secondary sources of income, assets, liabilities, proof of income

- Residential History: Details about current and previous residential addresses, including length of residency and landlord contact information

Leasing a car can be complicated, but you don’t have to go it alone.

Deciding if a Lease Is Right for You

Everyone has a different objective when they set out to get an automobile. Some people want a reliable vehicle that will last them for years to come. Others prefer less commitment, opting to trade in their car or truck every few years for a new model. While each option has its perks and drawbacks, deciding whether to lease or buy is the first step in your automobile journey.

The Case for Leasing a Vehicle

Vehicle leasing has changed drastically over the past few decades. What was once viewed as a method for dealerships to cheat customers out of equity has become an attractive alternative to purchasing. The rising cost of owning a vehicle has contributed to the popularity of leases. Although average costs appear to be falling, prices remain elevated, with the average price for a new car in 2024 exceeding $47,000.

Automobiles generally depreciate at an incredible rate, so the $47,000 car you purchased last month will be worth significantly less in the coming years. Aside from the lowered asset value, the three-year mark is typically when vehicles begin to require more extensive maintenance. With a lease, drivers have the luxury of swapping the vehicle for a completely refreshed model and avoiding potentially costly repairs. That isn’t to say a leased vehicle will never require repairs, but you will generally run into fewer problems the newer your vehicle is.

Leasing a vehicle is ideal for people who:

- Don’t want to pay high maintenance costs

- Want a new vehicle every few years

- Drive a limited amount of miles

- Don’t mind indefinite monthly payments

The Case for Purchasing a Vehicle

Purchasing a vehicle can make just as much sense as leasing. One of the most significant benefits of buying a vehicle outright is that you own it. You can make any desired modifications to the vehicle, and you don’t have to worry about mileage restrictions or additional fees for excessive wear and tear. Additionally, once your loan is paid off, you’ll no longer have monthly payments.

Although vehicles are typically considered a poor investment based on returns, owning a vehicle outright provides you with the opportunity to build equity. If you anticipate the vehicle’s value to appreciate due to limited production, rarity, or status as a collectible, purchasing offers a clear benefit over leasing. Cases such as this are rare, but for many people, the peace of mind that comes with owning a vehicle makes buying worth it.

Purchasing a vehicle is ideal for people who:

- Want the equity of an owned vehicle

- Drive an unpredictable amount of miles

- Want their car payments to end someday

- Don’t mind potentially high maintenance costs

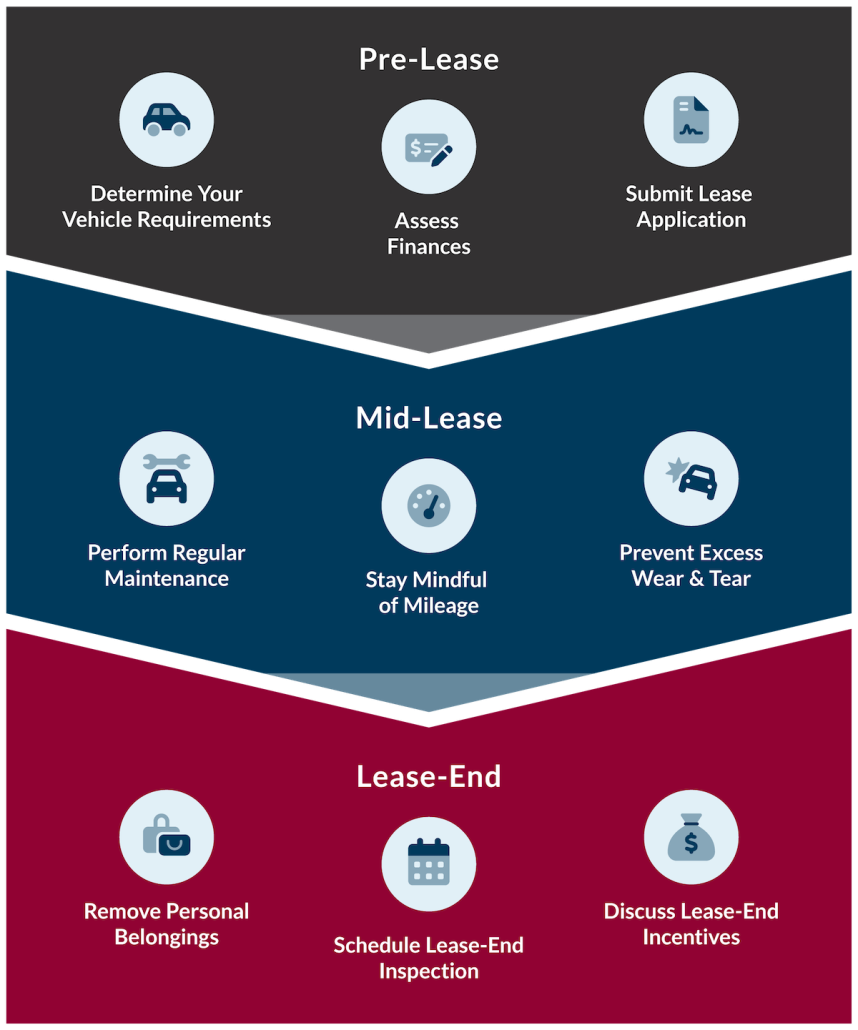

Preparing for the Lease

If you decide that leasing a vehicle is your best option, it’s time to make the proper preparations. Before visiting potential dealerships, take a step back and look at your overall situation. You will need to understand your vehicle requirements, financial situation, and desired lease length.

Some important questions to ask yourself when preparing for the lease are:

- How many miles do I expect to drive each month/year?

- What size vehicle do I need?

- What type of drivetrain (four-wheel drive, all-wheel drive, etc.) do I need?

- What is my budget?

- Do I anticipate any major life changes?

- How long do I plan on keeping the vehicle?

Once you perform that initial assessment and know what you’re looking for, it’s time to start shopping around. Visit a few dealerships, compare prices, and ask the right questions. All of our auto brokers are lease specialists and can help you navigate this process easily and seamlessly.

Negotiation

Have you ever noticed that car dealerships tend to cluster together? This isn’t by accident. Car dealerships work in an economy of agglomeration, which means that when similar businesses exist close to each other, the increased foot traffic leads to better sales. This is important for the dealerships regarding revenue, but it’s equally important to the customer. When you have multiple dealerships to choose from, you have multiple price points to choose from. Savvy buyers and lessees will leverage one dealership’s low price to get a lower price at another dealership. Although this process is time consuming, sometimes taking days or even weeks, it can result in significant savings.

Individual details will affect the price of a lease. When negotiating a lease, you need to compare exact details between dealerships to justify your tactics. To make sure you’re comparing apples to apples, ask these questions and keep a detailed record of each dealership’s answers:

- Vehicle Price: Make sure you are specific, as the same make and model often has various trim levels that influence the price. A Toyota Tacoma with the TRD Sport trim can be $20,000 more expensive than one with the SR trim.

- Down Payments: A higher down payment means lower monthly payments. While some dealerships offer zero down payment, others may require a down payment of several thousand dollars.

- Optional Features: Much like vehicle trim affects price, optional add-ons can also increase your monthly payments. Make sure the optional features remain consistent during the negotiation phase.

- Incentives and Rebates: Things get tricky with incentives and rebates, but this is where the bulk of negotiation lies. Dealerships often have manufacturer incentives, dealer discounts, and lease specials to lower prices.

- Mileage Limits: As a vehicle accumulates miles, its value goes down. A vehicle with 10,000 annual miles will have a cheaper monthly price than a vehicle with 25,000 annual miles.

Negotiating a lease is not for the faint of heart. Dealerships want to squeeze you for as much money as they can, and their salespeople are unlikely to roll over without a fight. If you don’t have a stomach for conflict, negotiating a lease will be unpleasant. In cases like this, working with an auto broker offers an excellent alternative, as you will hire an industry expert to negotiate on your behalf.

Leasing a car can be overwhelming, but with CLS, it doesn’t have to be.

During the Lease

After you decide on a vehicle, submit the application, and agree to terms, it’s time for the lease to begin. Although the bulk of the work is behind you, there are still several important things to keep in mind throughout your lease. If you break the conditions of the lease agreement, you run the risk of accumulating costly penalties. Here are the most critical things to be mindful of during your lease:

- Monthly payments: Missing payments is bad for your credit and can result in late fees or penalties. Set up automatic payments or monthly reminders to stay on top of your responsibility.

- Maintenance and Repairs: The lessee is responsible for maintaining and repairing the vehicle. Certain leases may restrict what replacement parts are acceptable. We advise you to verify whether or not original equipment manufacturer parts are necessary.

- Mileage Tracking: It can be easy to get carried away with miles traveled, but going over your yearly allowance will cost you. The typical charge is $0.25 per extra mile.

- Insurance Coverage: Like any other vehicle on the road, your leased car or truck must be insured. The premiums on leased vehicles tend to be higher than on owned cars, and most dealerships require comprehensive and collision coverage.

- Excess Wear & Tear: Just because you’re returning the vehicle at the end of the term, it isn’t an invitation to treat it carelessly. Be sure to use seat covers, keep it clean, avoid dents and dings, change your oil regularly, and avoid harsh driving behaviors.

Throughout your lease, stay in communication with your dealership. They often provide ongoing support and act as a valuable resource for any questions or concerns that you have during the lease term. It’s in their best interest to keep you happy and the vehicle well-cared for, so don’t hesitate to reach out with any questions. This is one of the main reasons why Centennial Leasing & Sales customers are customers for life. We truly care about our customers and their satisfaction with their vehicles and are always a phone call away with any questions you may have.

Breaking a Lease

Although a lease is a contract between you and the leasing company, the deal is rarely set in stone. If you experience an unexpected life change, financial hardship, a lease transfer opportunity, or simply change your mind, breaking the lease could be your best option. Breaking a lease is often a complex and expensive ordeal, so consider the situation carefully before committing.

Ask yourself how close you are to the end of the lease and if it’s possible to stick with it until the end. If you determine that staying in the lease is impossible, review the agreement so you understand the penalties. Look for provisions related to early termination and the applicable fees. The fees may include an early termination fee, remaining lease payments, excess mileage fees, excess wear and tear charges, and other taxes.

Once you’ve re-familiarized yourself with the lease conditions, explore your options. You may be able to transfer the lease to another individual who will assume responsibility for the vehicle. This could be mutually beneficial for both parties but will most likely result in additional fees.

Breaking a lease isn’t just bad for your initial financial situation. The repercussions dealt to your credit score could have a lasting effect. Early departure from a lease may be considered a default on the agreement, negatively impacting your credit score. Let your leasing company know of your intention to break the lease as soon as possible, as they may be able to help you end the lease on more favorable terms.

Approaching Lease-End

As you near the end of the lease, it’s time to start thinking about what you want to do after the lease ends. Your three options are to purchase the vehicle, lease a new vehicle, or return the vehicle and walk away. This step involves much of the same thought process as when you decided to lease.

If your situation has changed and you enjoyed the experience of the leased vehicle, you may be able to purchase it for its residual value. The process plays out much like any other vehicle purchase, and after the transaction is complete, you receive the title and registration for your new vehicle.

Deciding to lease another vehicle begins the process anew, minus the bulk of the negotiation steps. If you prefer more leverage for negotiation, your best option is to return the vehicle and walk away to shop around for deals.

Preparing for Lease-End

Before the lease ends, prepare the vehicle for its return to the dealer. The vehicle’s condition plays a significant role in determining your fees, so take care to make it as presentable as possible. Mechanical improvements and cosmetic fixes, such as ripped upholstery, dents, and scratches, are best left to the professionals, but there are a few DIY difference-makers that you can use:

- Wash the exterior of the vehicle

- Clean the insides of your windows

- Pick up trash and debris

- Vacuum floor and seats

- Remove personal belongings

- Return all original equipment, such as spare tires and all keys.

Once you have done everything you can to restore the vehicle to a condition similar to when the lease began, it’s time to schedule the lease-end inspection with the leasing company. The inspection will be a thorough assessment of the vehicle’s condition. If any damages or repairs are identified, the lessee will be responsible for covering the charges.

After The Lease

When the lease ends, you will meet with a representative to discuss your options and address any outstanding financial obligations. This is the perfect opportunity to explore lease-end incentives, which encourage lessees to continue doing business with the dealership. The most common incentives include discounts on leasing a new vehicle or purchasing the leased vehicle. They may also offer special financing options or discounts for renewing the lease.

The lease-end incentives benefit both parties, and it’s worth consideration. However, in the end, you must decide based on how a vehicle fits into your future plans. Regardless of how enticing the incentives may seem, it’s important to remember that you are not obligated to continue doing business with the company. If it makes sense to walk after the lease, do not be afraid to do so.

Leasing Made Easy with CLS

Leasing a vehicle can be a daunting task, especially if it’s your first time. But here’s the good news: You don’t have to navigate this complex process alone. By partnering with a local auto broker, you can avoid the tedious pains of negotiation, saving valuable time and reducing stress. Working with an auto broker provides you with an invaluable resource who knows the industry inside out. This industry knowledge is instrumental in sourcing the best deals, locating those hard-to-find vehicles, and making your leasing journey a breeze.

At Centennial Leasing & Sales, our expert auto brokers have a combined 500 years of experience pairing people with their dream cars. When you choose to work with a CLS auto broker, you’re not just another customer-you’re our priority. You’ll have one dedicated point of contact throughout the entire process, ensuring a seamless and personalized experience. We understand the value of a satisfied customer, and we’ll go above and beyond to ensure you drive away with a smile on your face.

Are you ready for your BEST automotive buying experience? Let us know how we can help!